Growth Accelerates in Lower End of Commercial Market

As prices get stupid for the product of choice – the triple net or absolute net, S&P BBB or better, single tenant retail, it starts pulling up secondary and tertiary markets and slightly weaker credit single tenant retail. Multi tenant won’t be far behind. We’re now in a broad based recovery that is pulling the entire commercial real estate market forward. This is pretty much common sense, but I thought I would point this out.

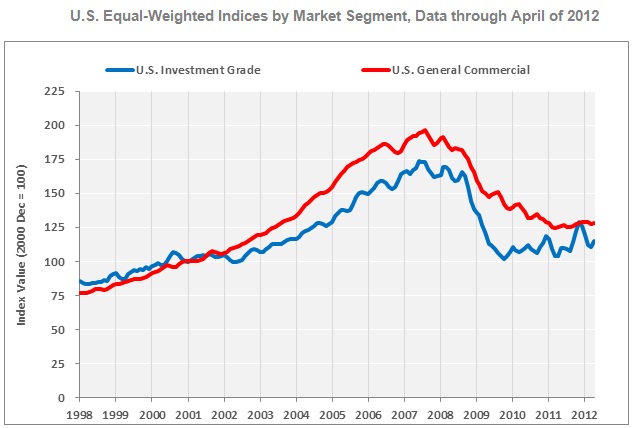

The recovery was far from broad based when it began about 18 months ago pulling only the highest end properties in coastal primary markets forward. However as pricing has gotten out of line with sub 5% caps common in these markets, investors have shifted focus to secondary markets. Pricing momentum has shifted from the high end triple net and absolute net properties to the boarder market dominated by smaller cheaper properties.

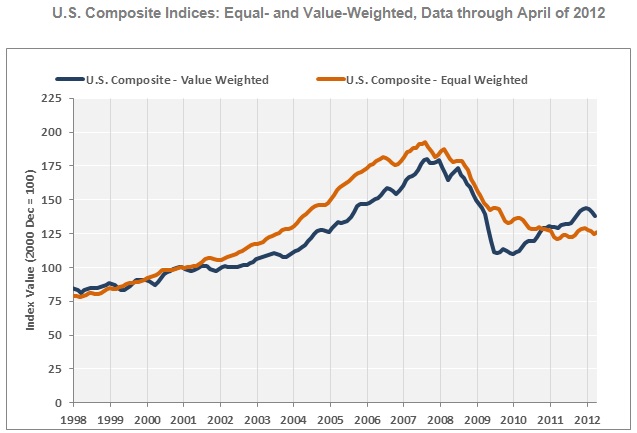

CoStar’s ‘value weighted composite index’ has slowed from double digit growth throughout 2011 to 6.5% year over year gain in April.

We’re seeing liquidity improving starting with transaction volume. Costars calculations of ‘sales pairs ‘ have increased 19% for the previous 12 month period. The growth has been biased toward investment grade properties but as I mention earlier, this is starting to shift top lower grade properties.

Given the issues in Europe right now, were seeing a large role from European buyers driving up activity to a level triple of what it was in 2011.

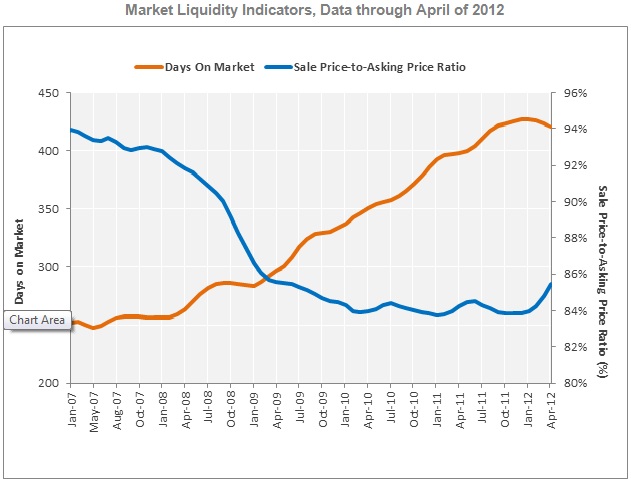

Tim on market is decreasing for the first time since the recession began and with that the gap between initial asking price and sales price at its fastest rate since 2006.

Distress levels are down 12.2 from last years to 24.3% of all transactions. It’s shaping up to be the best year we’ve had in this business in the last five or six years. All I can say is that it’s about time.

http://www.costar.com/ccrsi/index.aspx

Follow

Follow